Introduction

Starting January 2025, Germany mandates electronic invoicing (e-invoicing) for specific transactions, France is joining the movement in 2026, introducing a significant shift in

business practices. Understanding the core components of this change – XRechnung and ZUGFeRD – is crucial for compliance and

smooth business operations.

TL;DR Too long; Didn't read!

- XRechnung: is the XML file with all data for an invoice, this file is used in your accounting software.

- ZUGFeRD: It is the PDF invoice file with the XRechnung .XML file attached

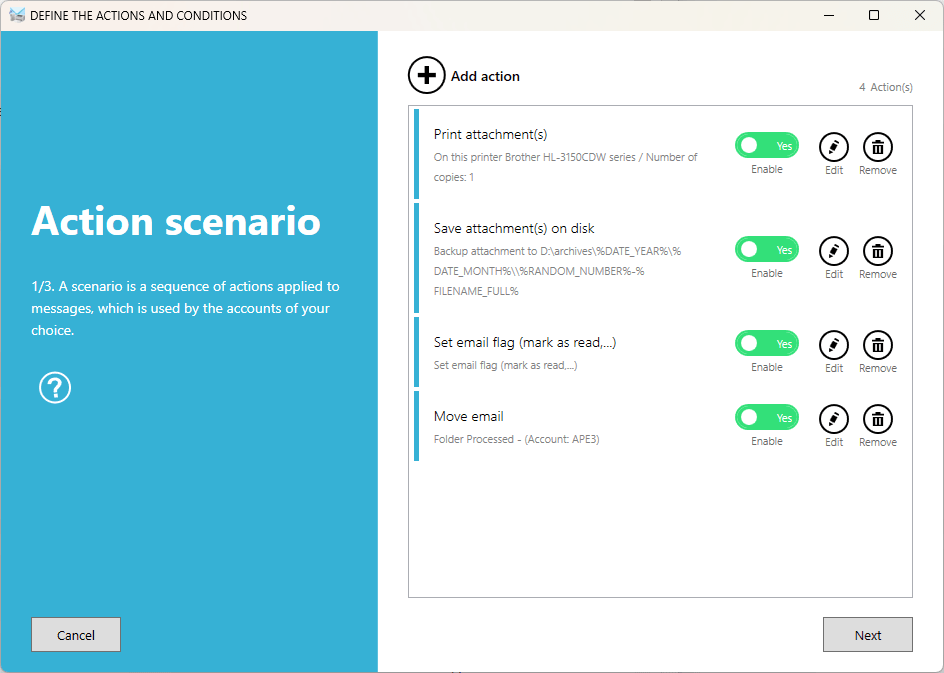

- Automate the print and archiving process with Automatic Email Manager

What are XRechnung and ZUGFeRD?

XRechnung is the structured data format for electronic invoices in Germany and France. Based on XML (Extensible Markup Language), it contains all the necessary invoice

information in a machine-readable format, enabling automated processing and validation. Think of it as the structured data "backbone" of the e-invoice.

ZUGFeRD (Central User Guide of the Forum for Electronic Invoicing in Germany) complements XRechnung. It provides a standardized way to embed the structured

XRechnung XML data within a human-readable PDF invoice. This hybrid approach ensures that while machines can process the XML, humans can easily read and

understand the invoice in a familiar PDF format. Importantly, the XML and PDF represent the same invoice data.

Why a PDF alongside XML?

While XRechnung (XML) enables automated processing, a human-readable version is essential for practical reasons:

- Easy Review and Verification: People need to be able to quickly review invoice details without specialized software.

- Archiving and Audit Trails: PDFs provide a readily accessible format for record-keeping and audits.

- Dispute Resolution: A clear, human-readable format simplifies resolving discrepancies or disputes.

- Accessibility Not all businesses have systems capable of directly processing XML. A PDF ensures everyone can access the invoice information.

Printing ZUGFeRD/XRechnung PDFs with Automatic Email Manager

Automatic Email Manager offers a streamlined way to manage, save on disk and print these e-invoices. Here's how to autoamtically save on disk or print the PDF

invoice provided with the electronic XRechnung or ZUGFeRD:

1. Download and install Automatic Email Manager. Configure it to access the email account where you receive invoices.

2. Create a Scenario for Invoice Processing: Add the actions you need: 'Print attachments' and 'Save attachments' (if you want to save on disk for integration in your accounting software). Set up a condition within the scenario specifically to handle incoming invoices. This condition should identify emails containing XRechnung or ZUGFeRD attachments (typically identified by file extensions like .xml and .pdf).

XRechnung is mandatory, handle them with Automatic Email Manager

By automating the process to automatically save or print the e-invoice received, Automatic Email Manager saves you time and reduces manual effort, allowing you to focus on other critical business tasks. Contact us today to learn more about how Automatic Email Manager can optimize your e-invoicing processes.